On May 5, 2015, the citizens of Michigan are being asked to vote on Proposal 1, which is the State Legislature’s solution to finding more funding to improve Michigan’s roads. In a nutshell, the proposal is asking voters if they support amending the State Constitution to:

- Eliminate the sales and use tax on gasoline

- Increase the sales and use tax from 6 percent to 7 percent

- Increase the portion of the use tax that goes to the School Aid Fund and extend those benefits to higher education and training centers

- Increase the gas tax and vehicle registration fees

- Increase the earned income tax credit

(For the exact ballot language please click here.)

Although the proposal, if passed, would affect more than just road funding, much of the discussion revolving around it has been centered on the roads, as can be seen by information offered by the Southeastern Michigan Council of Governments, the Citizens Research Council, state and local road departments and even school representatives.

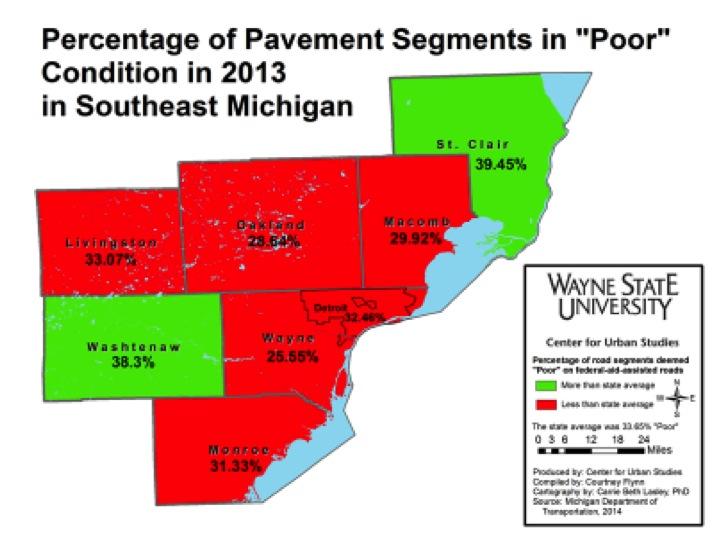

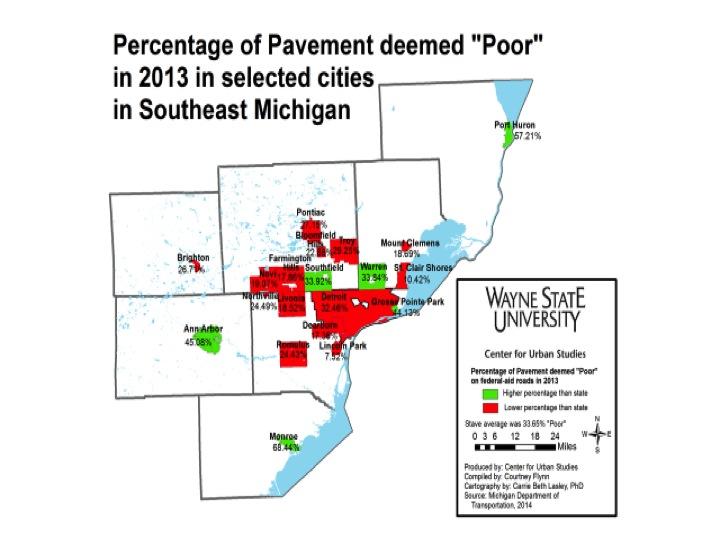

For the purpose of this post, we show what percentage of pavement segments throughout the Southeastern Michigan region were deemed by the Michigan Department of Transportation to be in “good,” “fair,” and “poor” conditions in 2013. Additionally, we look at the condition of bridges in the region during 2014.

The Pavement Surface Evaluation and Rating (PASER) system was used to determine the conditions of the roads in 2013. According to this system, a road in “fair” condition needs preventative maintenance while a road in “poor” condition needs a structural fix.

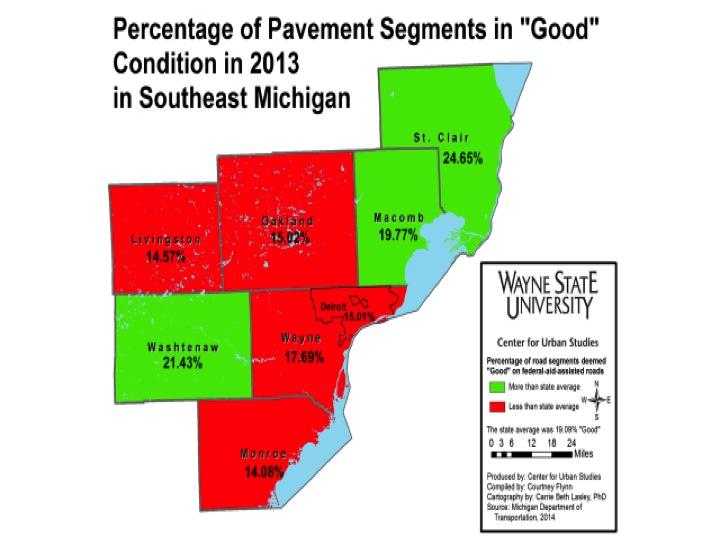

Not one of the seven counties in the Southeastern Michigan region had above 25 percent of its pavement segments deemed to be in “good” condition in 2013 by the Michigan Department of Transportation. St. Clair County had the highest percentage of “good” pavement segments at 24.65 percent and Monroe County had the lowest at 14.08 percent. In comparison to the state average (19.09%), Washtenaw, Macomb and St. Clair counties were the only counties in the region with a higher percentage of pavement segments deemed to be in “good” condition.

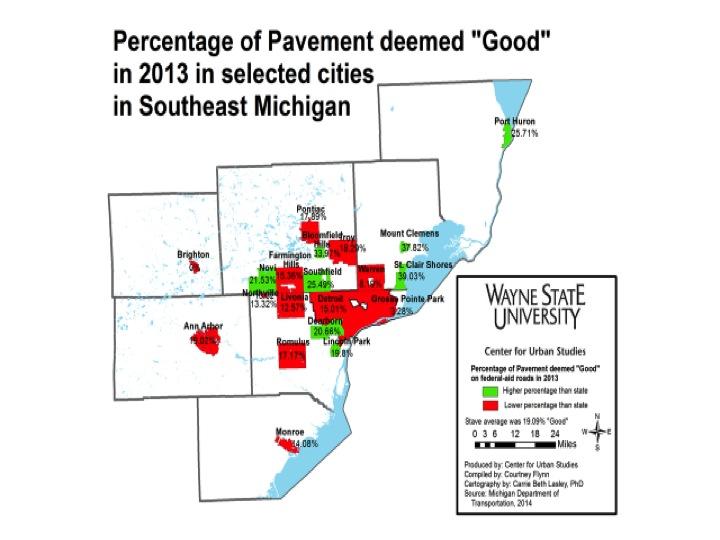

When looking at the percentage of pavement segments deemed to be in “good” condition by city, we see that Brighton had 0 percent of its pavement classified with this distinction. Brighton is located in Livingston County and only 14.57 percent of the pavement segments in the county were in “good” condition in 2013. Although only 15.15 percent of Detroit’s road were deemed to be in “good” condition in 2013, there were other cities with a lower percentage of “good” pavements. These cities include: Warren, Grosse Point Park and Livonia.

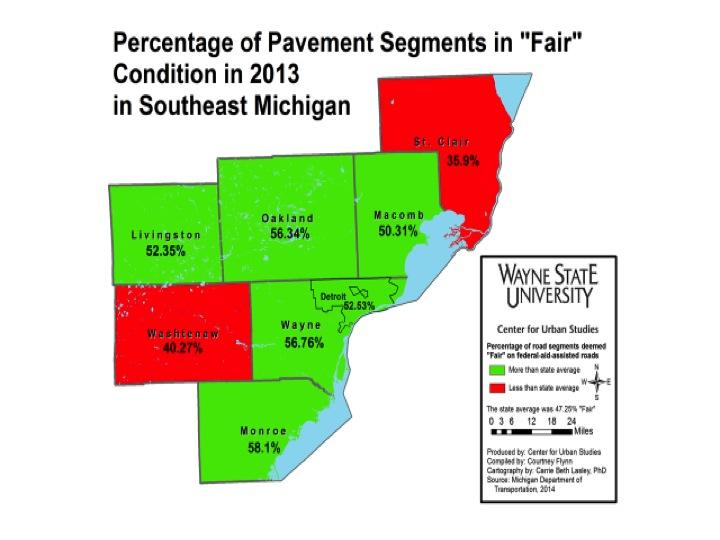

The percentage of pavement segments in “fair” condition throughout the region is higher than those in “good” condition for all seven counties. Monroe County had the highest percentage of segments in “fair” condition at 58.1 percent, while St. Clair County had the lowest at 35.9 percent. Only St. Clair and Washtenaw counties had a lower percentage of “fair” pavement segments than the state average, which was 47.25 percent.

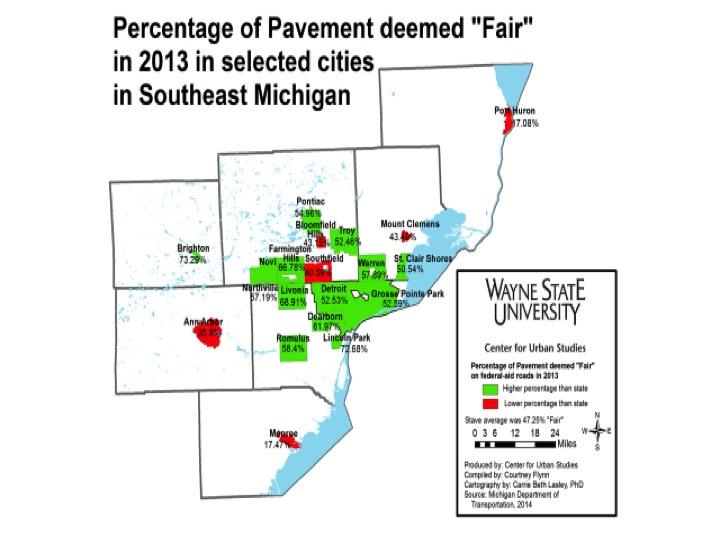

A look at the cities’ pavement conditions shows that Brighton had the highest percentage of “fair” roads at 73.29 percent. The city of Monroe has the lowest percentage at 17.47 percent; this was lower than the state average. Other cities with the percentage of “fair” pavement conditions below the state average were: Ann Arbor, Detroit, Mount Clemens and Port Huron.

About a third of the region’s pavement segments were deemed to be in “poor” condition (32.3% average for the region), a figure similar to the state average (33.65%). When looking at each individual county in the region, we see that only two-Washtenaw and St. Clair-had a higher percentage of “poor” pavement segments than the state average. St. Clair County had the highest percentage at 39.45 percent and Washtenaw County came in just below that at 38.3 percent.

Port Huron, located in St. Clair County, had the highest percentage of pavement deemed to be in “poor” condition at 57.21 percent. Lincoln Park had the lowest at 7.51 percent. Detroit came in at 32.46 percent.

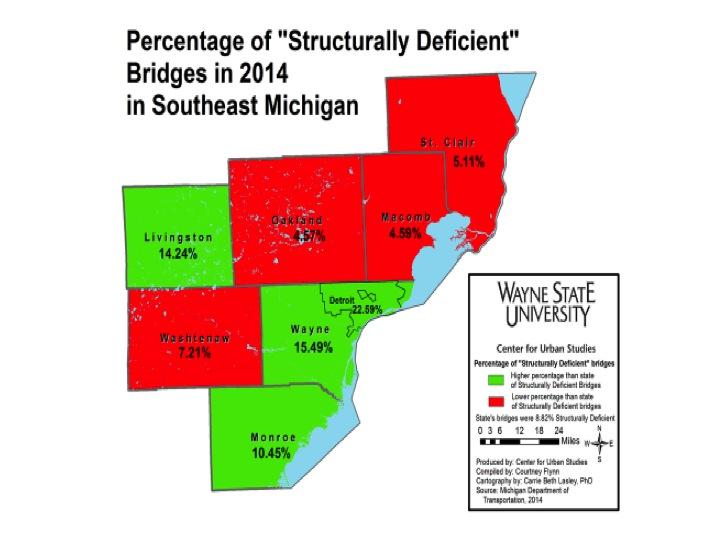

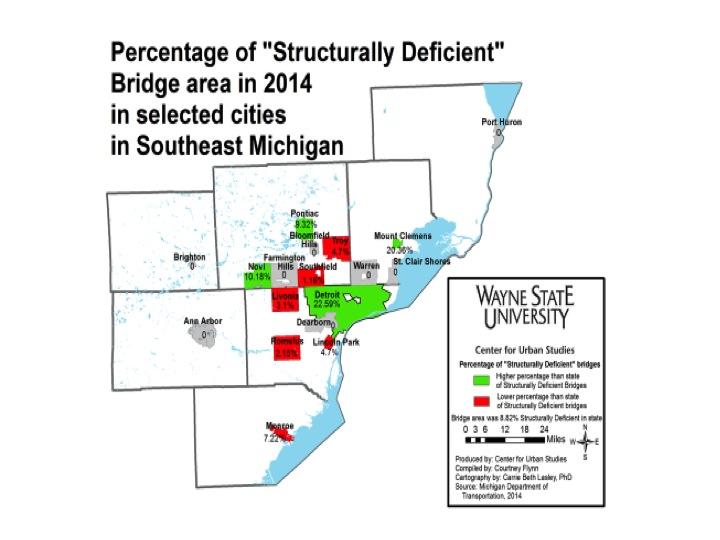

Wayne County had the highest percentage of structurally deficient bridges in the region in 2014 (15.49 percent), according to the Michigan Department of Transportation. For the city of Detroit, 22.59 percent of its bridges were deemed structurally deficient at that time. In recent weeks, it has been reported by the Detroit News that the I-75 Rouge River Bridge in Detroit is so structurally deficient that holes can be seen through the pavement in some areas. The Fort Street and Jefferson Avenue bridges over the Rouge River in that area are also closed for construction. The West Jefferson Avenue bridge has been closed for repair since 2013 because a bridge operator closed it on a passing boat, according to the News Herald. In addition, the News Herald reports that the Fort Street bridge over the Rouge River has been closed since 2013 because of necessary maintenance projects.

Outside of Wayne County, Livingston and Monroe were the only other counties in the region with a higher percentage of structurally deficient bridges (14.24% and 10.45%, respectively) than the state average (8.82%).

Aside from Detroit, the city of Mount Clemens was the only community shown in this post that had more than 20 percent of its bridges deemed structurally deficient.

The information presented throughout this post highlights the conditions of Southeast Michigan’s roads and bridges. The May 5 ballot proposal, Proposal 15-1, is being presented by Governor Rick Snyder as the solution to ensuring Michigan’s roads receive additional funding so the number of roads in poor conditions doesn’t continue to increase. However, approval of this ballot proposal does mean tax increases. The proposed sales and use tax increase, from 6 to 7 percent, would be used to increase state revenue sharing to cities, townships, villages and counties; it would also increase monies going to the School Aid Fund. These monies would not be used on roads, according to the Citizen’s Research Council.

While gasoline and diesel fuel would be exempt from the sales and use taxes under this proposal, the overall gas taxes would increase to 14.9 percent of the price of each fuel; these initial tax rates would be 41.7 cents for each gallon of gas and a 46.4 cents for each gallon of diesel, according to the House Fiscal Agency. These monies, along with increased vehicle registration revenues, would be solely used for transportation and road funding, according to the Citizens Research Council. However, as reported in the Detroit Free Press and other news outlets, if Proposal 15-1 passes about $13.5 million dollars of the new road money would be spent on Michigan Department of Transportation debt in the fist two years.

What has been touched upon in this post is just scratching the surface on the intricacies of this proposal and the background on Michigan’s road conditions, to learn more about this proposal visit the following sites:

http://www.crcmich.org/PUBLICAT/2010s/2015/transportation_funding_proposal.html