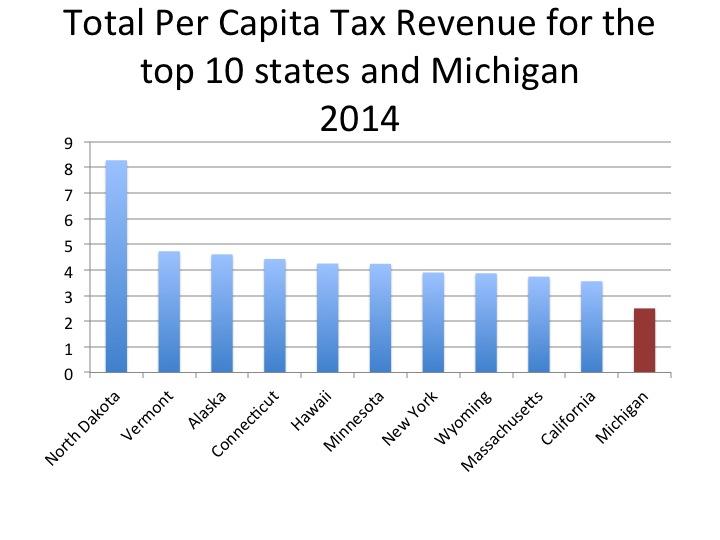

The chart above compares the taxes per capita in Michigan, which is $2.50, to the 10 states with the highest taxes per capita. Michigan ranked 31 out of 50 and North Dakota came in at number 1 with its taxes per capita at $8.28.

Other states in the Great Lakes region with higher taxes per capita than Michigan were: Minnesota ($4.24), New York ($3.90), Illinois ($3.04), Wisconsin ($2.85) and Indiana ($2.55).

Nationwide, New Hampshire had the lowest taxes per capita in 2014 at $1.72.

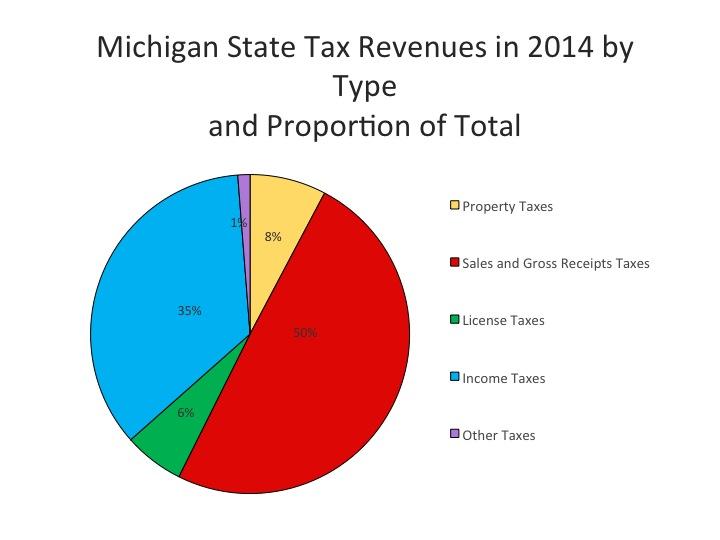

As seen in the graph below, the State of Michigan’s tax revenues come from four primary categories: Sales and Gross Receipt Taxes, Income Taxes, Property Taxes, and License Taxes. All other taxes, which include death and Gift Taxes, Documentary and Stock Transfer Taxes, and Severance Taxes, fall into the “Other” category. This category accounted for only 1 percent of the state’s tax revenue in 2014 while sales and gross receipt taxes accounted for 50 percent, or about $12 billion, of the state’s tax revenue.

The information for this post was taken from the 2014 Annual Survey of State Government Tax Collections.

As noted, half of Michigan’s tax revenue generated in 2014 was from sales and gross receipt taxes, a category that is made up of more than just general sales and gross receipt taxes. General sales and gross receipt taxes accounted for 68 percent of the overall sales and gross receipts of $12 billion brought in 2014 while about 8 percent of those monies were earned through the motor fuel tax.

Michigan also relies on income tax monies to fund state operations; 35 percent of Michigan’s tax revenue generated in 2014 (about $8.7 billion) came from income taxes. Of that, 89 percent came from personal income taxes and the remainder was generated from corporation net income taxes.

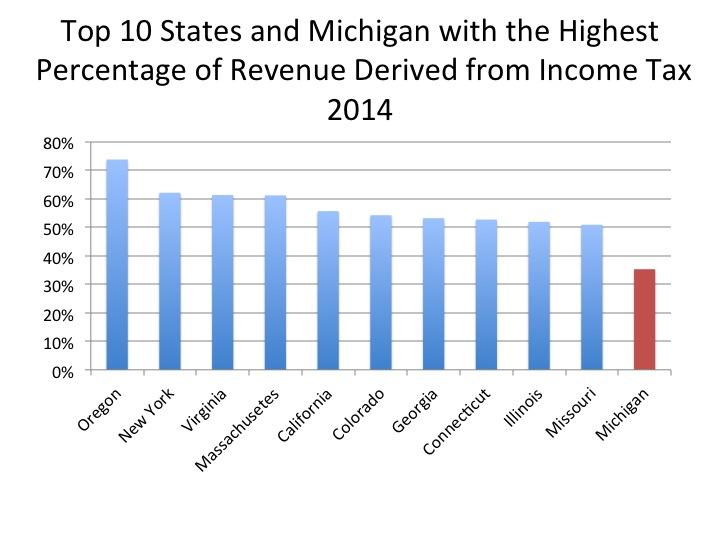

Overall, according to the National Conference of State Legislatures, states earn about a third of their tax base through income taxes. Though this varies substantially as discussed below.

The majority of Oregon’s tax base (74%) was earned through its income tax in 2014, while Michigan only derived 35 percent of its tax base from income tax. Oregon’s income tax is divided into four brackets depending on a person/family’s earning. In addition, Oregonians are able to subtract what they pay in federal taxes from their state taxable income results, according to an article from The Oregonian.

Michigan has a flat income tax. In Michigan the income tax rate is 4.25 percent, however Republicans in the State Legislature have been working to reduce it to 3.9 percent, according to the Michigan League for Public Policy (MLPP). Such action, according to the MLPP, would reduce revenue flow to areas such as education and infrastructure. Michigan also has an Earned Income Tax Credit that allows lower income workers to retain more of their income. The State Legislature intends to eliminate this credit and instead push those funds into Michigan’s roads.

In addition to the Earned Income Tax Credit that exists in Michigan, and 23 other states (including Oregon), there is also a federal one, according to the National Center for Children in Poverty.

The importance of income taxes has grown since reliance on property tax values has declined in recent years, according to the National Conference of State Legislatures.

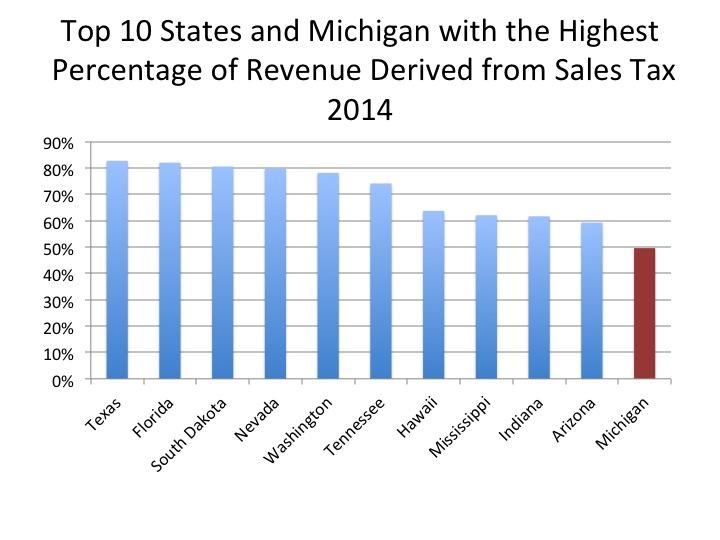

With Michigan’s sales and gross receipt taxes making up 50 percent of the state’s tax generated revenue in 2014, it ranked 19th for percent of sales tax making up a state’s tax base. Texas ranked first with 83 percent of its tax base being made up of sales taxes. Texas is one of the 17 states in the U.S. that does not levy property taxes at the state level, though it does have property taxes at the municipal and county level. Other states that do not levy property taxes (at the state level) and are among the 10 states with the highest percentage of revenue derived from sales taxes include: Florida (2), South Dakota (3), Tennessee (6) and Hawaii (7). Indiana was the only Midwestern state of the 10 states with the largest portion of their tax base being made up of sales taxes. In 2014, 62 percent of Indiana’s tax revenue was earned through sales taxes.

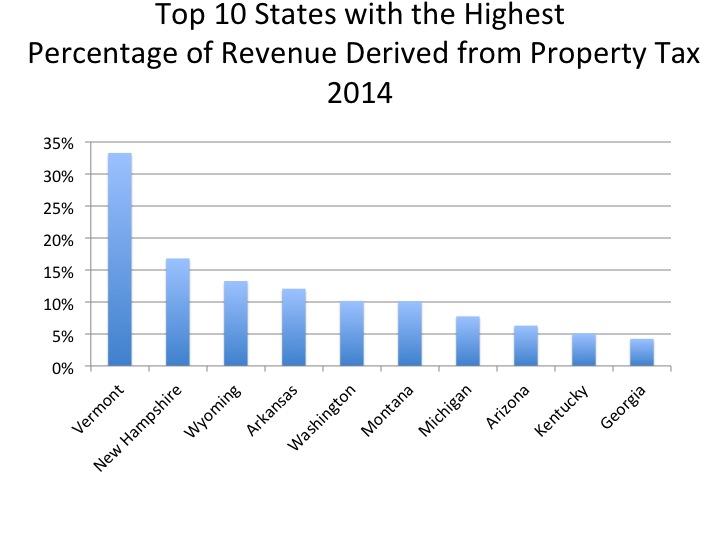

Out of the 33 states in the U.S. that levy property taxes, Michigan ranked seventh for the percent of tax revenues derived from property taxes. In total, about 8 percent of the state of Michigan’s tax revenues, or $1.8 billion, came from property taxes. Vermont ranked at the top, with 33 percent of its state tax revenues comprised of property taxes.