In Southeastern Michigan, home prices are on the rise, as are the number of housing units being built, while mortgage rates appear to be slowly, and slightly, decreasing. Such indicators, which are more closely examined in this post, speak to a slow ongoing recovery in housing and possibly higher homeownership rates. However, since the number of building permits being pulled include many multi-family units, it is perhaps also true that higher rents, a trend we have been following, are drawing more investment into rental housing.

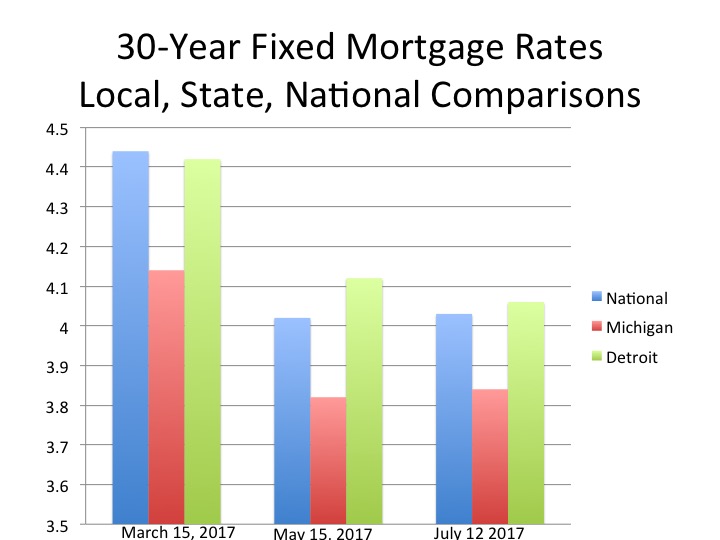

Above are three average 30-year mortgage interest rates at the national, state and local levels. These rates were provided by bankrate.com, which does a national survey of large lenders on a weekly basis. As a 30-year fixed rate mortgage is the most traditional type of home financing, this was chosen to show the rate differences. On average, the State of Michigan had the lowest average interest rate for the week of July 12 at 3.84, which was 0.02 points higher than the last time we examined that data. Of the three months for which we have examined mortgage rates, Michigan’s continues to remain the lowest.

Also during the week of July 12, 2017 Detroit’s average 30-year fixed mortgage interest rate was higher than the national average. At this point in time, Detroit’s average was 4.06 and the national average was 4.03. Between May and July, the 30-year fixed mortgage rate for the Detroit area decreased (it was 4.12 in May and was 4.06 the week of July 12) but it increased by 0.01 on the national level (it was 4.02 in May).

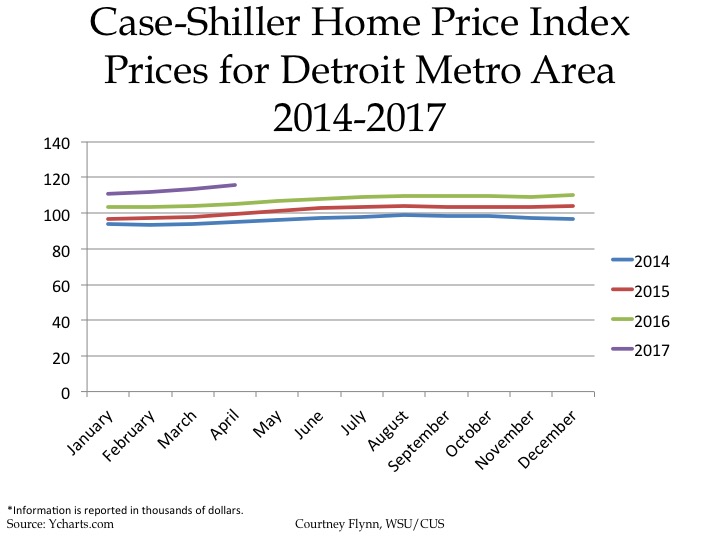

The above charts show the Standard and Poor’s Case-Shiller Home Price Index for the Detroit Metropolitan Statistical Area. The index includes the price for homes that have sold but does not include the price of new home construction, condos, or homes that have been remodeled.

According to the index, the average price of single-family dwellings sold in Metro Detroit was $115,610 in April 2017. This was an increase of $10,390 from April of 2016 and an increase from $16,110 from April of 2015 and an increase of $20,750 from April of 2014. Between just March and April of this year the average home price in the region increased by $2,030.

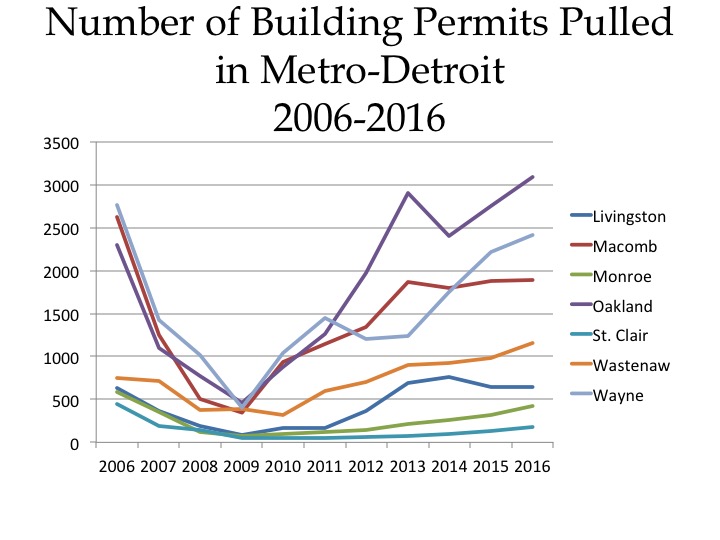

Between 2006 and 2016, according to the Southeastern Michigan Council of Governments, the number of building permits pulled dropped to a low in 2009, mid-recession. The number of building permits reported for each county includes single family, two family, attached condo and multi-family units.

The number of building permits pulled have recovered for all seven counties in the region since the 2009 nadir. However, only three of the seven counties have outpaced their 2006 numbers. These counties are Livingston County, Oakland County and Washtenaw County. The difference between the number of 2006 building permits and 2016 building permits for each of these three counties are:

- Livingston: 59

- Oakland: 786

- Washtenaw: 405

Of the four counties where building permit numbers have yet to recover to 2006 numbers or beyond, Macomb County had the biggest difference at 739. In 2006 there 2,626 building permits pulled in Macomb County and in 2016 there were 1,887. For Wayne County, there was 356 difference in that time frame. There were 2,766 building permits in Wayne County in 2006 and in 2016 there 2,410.

Overall, in 2016, Oakland County had the highest number of building permits pulled at 3,088. Oakland County has had the highest number of permits pulled, regionally, since 2012 when it surpassed Wayne County.

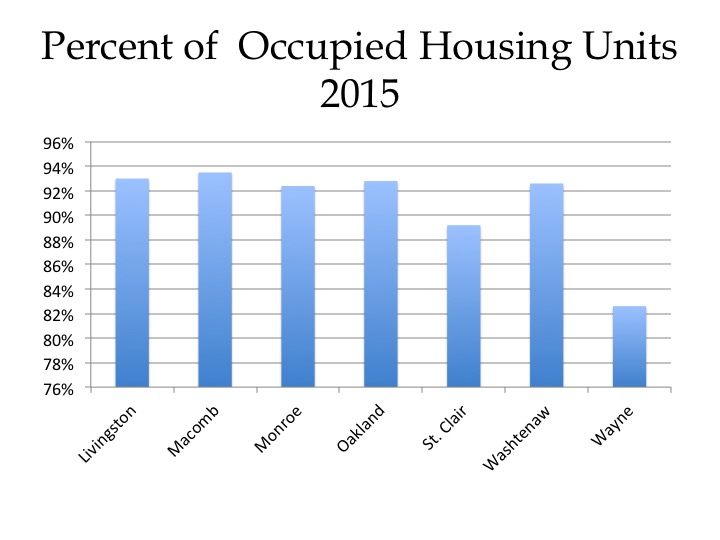

According to the 2015 American Community Survey, Wayne County had the lowest percentage of occupied housing units at 83 percent, meaning there was a 17 percent vacancy rate in the county in 2015. Macomb County on the hand had the highest occupied housing unit rate in the region at 94 percent. Livingston, Oakland and Washtenaw counties all had 93 percent occupied housing unit rates, and Monroe County had a 92 percent occupied housing unit rate. The only other county in the region that had an occupied housing unit rate below 90 percent was St. Clair County. In 2015, St. Clair County had an 89 percent occupied housing unit rate.

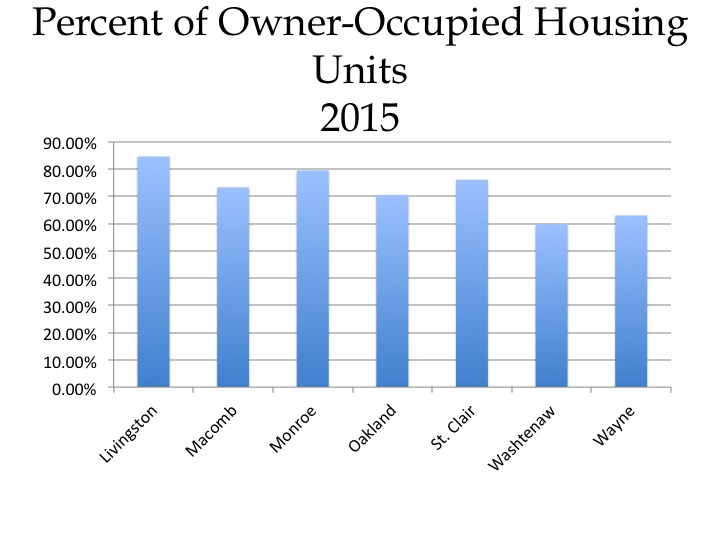

In 2015, according to the American Community Survey, Livingston County had the highest home-ownership percentage at 84.6 percent while Washtenaw County had the lowest at 59.8 percent. It should be noted though that the University of Michigan is located in Washtenaw County, meaning off-campus student housing is typically made up of rental units. In Wayne County, the percentage of owner-occupied housing units was 63 percent. It was only Washtenaw and Wayne counties where the percentage of homeowners was below 70 percent.