For majority of the states and local government entities across the country one of the most attractive pieces of their compensation packages has been the offering of retiree health care, dental and vision insurance after retirement and life insurance. These benefits are referred to as Other Post Employment Benefits (OPEB) and are not part of an employee’s pension fund. According to the International City/County Management Association (ICMA) OPEB packages have traditionally been generous (ie. Offering full medical insurance coverage after retirement) as a way to attract talent, since public sector salaries are typically lower than those in the private sector. While public employers (ie. state and local government agencies) have traditionally funded their pension obligations during the time in which employees are working, majority of OPEB funding isn’t paid for until after employees retire in a pay-as-you-go manner, according to Michigan State University-Extension. In 2007, the Governmental Accounting Standards Board required all U.S. municipalities to measure the OPEB percent funded and unfunded in their community, which had not been required before. Prior to this change, according to ICMA, most government entities had only incrementally calculated what was owed on an annual basis in context to their annual budget. This new accounting standard though forces government entities to examine what their OPEB costs will be over the long-term and how it will affect their budget, especially as the cost of medical care continues to rise. According to research conducted by Michigan State University-Extension, the burden to fund OPEBs has proven to be a financial stressor for many communities in Michigan, and beyond.

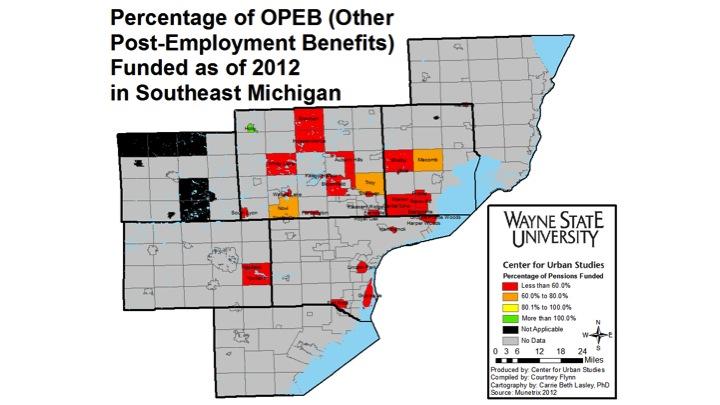

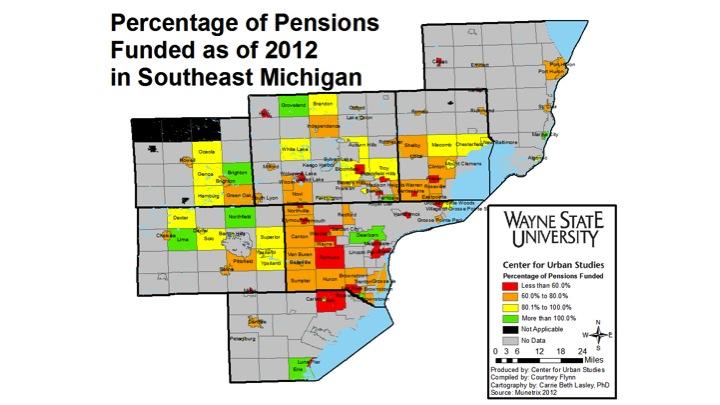

The maps below showcase survey data from the public-sector-financial-based website Munetrix.com; not all communities in Southeastern Michigan represented and only the data discussed below if representative of the communities’ whose information was made available on the website. According to available data, 99.7 percent had 80 percent or less of their OPEB liabilities funded in 2012 while 62 percent of communities with available 2012 pension funding data had 80 percent or less of their defined pensions funded. While there is no single number for whether an OPEB, or pension fund, is healthy or unhealthy there are frequent references in the accounting world that if such a fund is funded at 80 percent or higher it is considered healthy, according to a 2007 Government Accountability Office report. The lack of funding of OPEB obligations above 80 percent compared to pension funding above 80 percent is not unique to Southeastern Michigan, or the communities throughout the state, at all. Rather this is a growing problem communities across the country are trying deal with, according to Michigan State University-Extension.

As noted above, and as can be seen in the maps, more data was provided on pension funding than OPEB funding by Munetrix. Just as data lacks on OPEB funding so does the percent of such funded liabilities. In the region in 2012, according to the data presented, the city of Holly had the highest percent of OPEB funding at 121 percent; Macomb Township came in second to with62.9 percent. Several of the communities with information available had 0 percent of their OPEB liabilities funded. These communities were:

- Flat Rock

- Grosse Ile

- Grosse Pointe Woods

- Hamtramck

- Harper Woods

- Lincoln Park

- Clawson

- Memphis

- Fraser

For 2012, OPEB funding information was not available on the city of Detroit through Munetrix. However, through court documents related to the City of Detroit’s bankruptcy filing , in 2011 Detroit’s OPEB liability was 99.6 percent unfunded; the total OPEB liability at that time was $5.7 billion. Before bankruptcy proceedings were complete, the city had 22 different OPEB related plans, 15 of which were directly related to medical and prescription drug care. Since Detroit came out of bankruptcy its retiree healthcare benefits are funded through two Voluntary Employment Benefits Association trusts. In total, it is estimated these funds will have $450 million put into them to fund the city’s OPEB, according to the Detroit News.

Also when viewing the pension map we see that information for the city of Detroit was not provided for this as well. The city has two pension systems, the general employee pension system and the police and fire system. According to the bankruptcy documents, by the end of 2011 the city owed $1.7 billion to the general employee system and $1.6 billion to the police and fire system.

As Detroit exited bankruptcy in 2014, according to the New York Times, the general employee pension system was 74 percent funded and the fire and police system was 78 percent funded. From now through 2024 the city will not contribute to the pension fund from general fund dollars. Instead, revenues from the Detroit Water and Sewerage Department, settlement monies from general-obligation bondholders and donations from foundations and the state (as part of the “grand bargain“) will fund the pension system, according to the Detroit News.

When looking back at the communities that did have pension data available for 2012 we see that 38 of the 98 had their pension systems funded at 80 percent of above. Of those, the communities below had their pension systems funded above 100 percent:

- Dearborn

- Rockwood

- Lima Township

- Northfield Township

- Marine City

- Ferndale

- Groveland Township

- Royal Oak Charter Township

- Erie Township

- Brighton Township

Of the communities that had their pension liabilities funded below 80 percent in 2012, Lincoln Park had the lowest at 34.6 percent.