The state of the roads in Michigan are well known to be largely in poor condition, and funding never seems to be at a point to allow for a total overhaul toward long-term improvement. Road funding in Michigan doesn’t come from one dedicated source. Rather, there is federal funding provided by the Federal Highway Administration Highway Trust Fund, state funding provided by state fuel taxes, vehicle registration fees, income taxes, additional appropriations decided on by the Legislature, and local funding provided by general tax revenue and additional road millages. This post shows the communities in Southeastern Michigan that have additional road millages to further improve the roads.

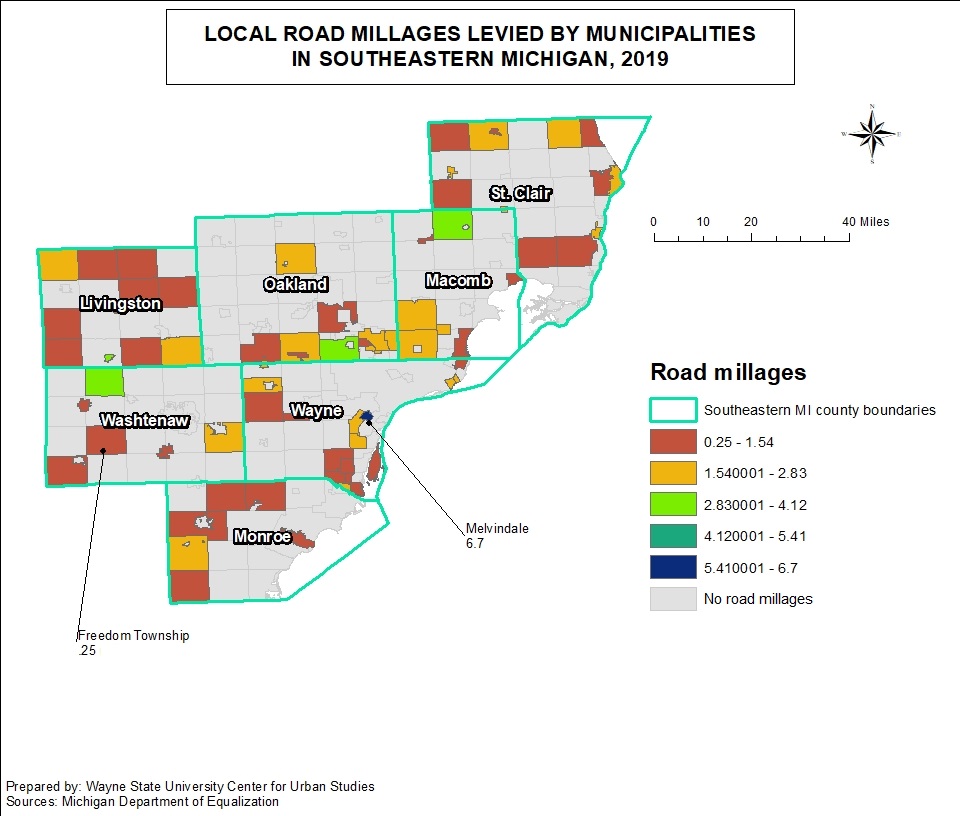

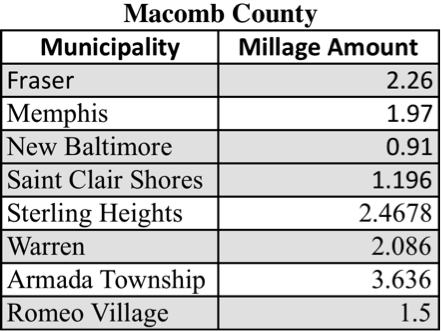

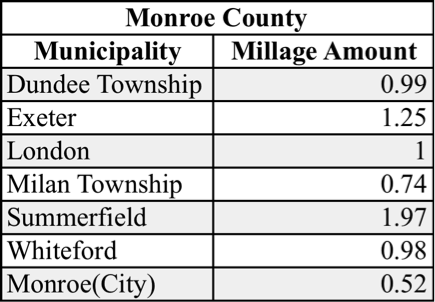

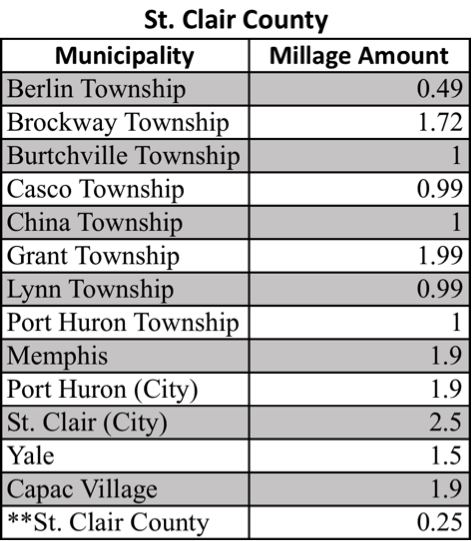

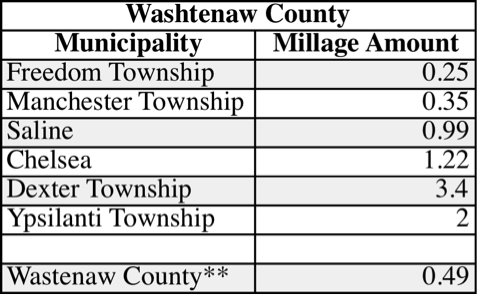

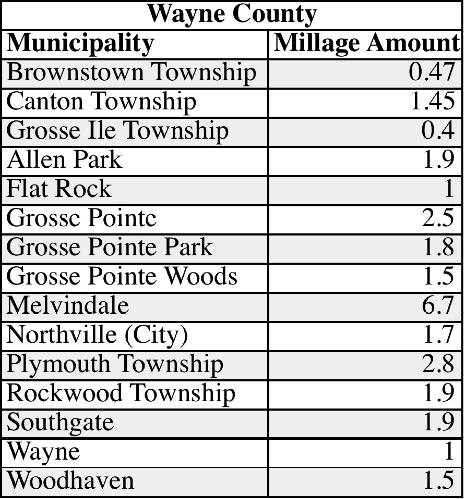

According to the data provided by the Michigan Department of Treasury, there are 73 communities in Southeastern Michigan that levy an additional tax to support road funding, along with two counties. These millages are intended to improve road funding. Of all the communities that levy a road millage, the City of Melvindale has the highest road levy at 6.7 mills, followed by the City of Grosse Pointe and the City of St. Clair which both levy 2.5 mills. The City of Sterling Heights levies the fourth highest amount in the region at 2.47.

Freedom Township and St. Clair County levy the lowest amounts at 0.25 mills each. The only other county in the region to levy a road tax is Washtenaw County which has a 0.49 millage.

Another item to note is that there are more townships levy road taxes than cities and villages. This is likely due to the fact that township roads are controlled by county road departments/commissions, meaning more competition for road dollars.

A mill is a $1 tax per $1,000 of assessed taxable value. For example, a homeowner with a house assessed at $200,000 (true value at $400,000) in a city that levies a 2.5 millage would pay an additional $250 in city taxes. Of course, how much money a community receives in total from a road millage will vary depending on the number of homes in a community along with the average home value of a community.

According to the Mackinac Center for Public Policy there is a strong correlation between improved road conditions and a road millage. According to the Center, 58 percent of roads in a city without a road millage are in poor condition. And, if a city has a road millage, each mill is correlated with a six-point reduction in the percentage of roads in poor condition. This is not necessarily true for villages, where 47 percent of roads in villages without a road millage are in poor condition. This differentiation could be due to the fact that villages typically have less taxable property value, meaning they would need a higher levy to get the dollars needed for more improvement.

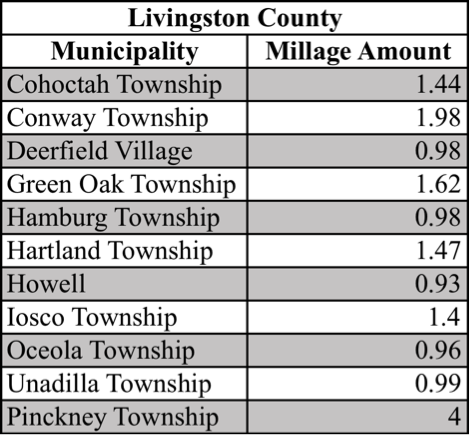

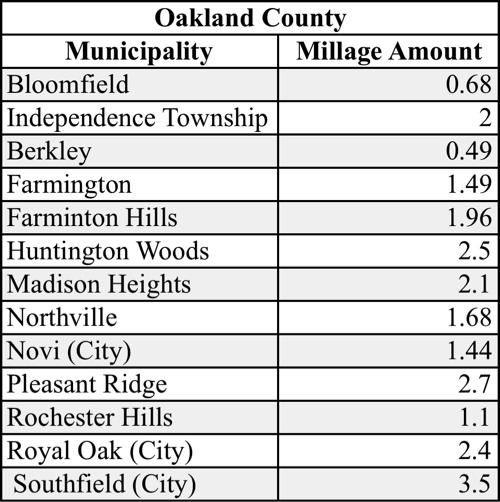

Below is a map of communities in Southeastern Michigan that levy a road tax, along with lists to show what communities are making additional investments into their road infrastructure.