We are a year into the COVID pandemic, unemployment rates have peaked and then declined, but they are still substantially higher than a year ago. Average home prices have increased as demand for homes has increased. Broader consumption trends though, while they are faring better than nearly a year ago, have yet to fully recover to pre-pandemic levels. Below we show just how these various indicators have changed over the last year.

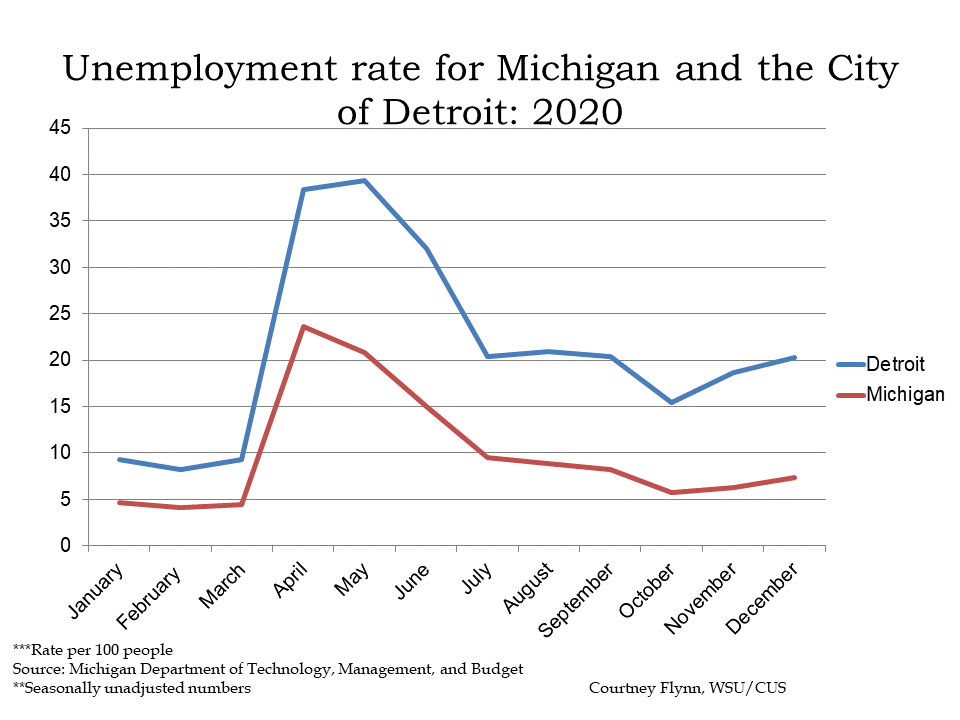

In December of 2020 the unemployment rates for the State of Michigan and for the City of Detroit continued to increase after declines following the initial unemployment spikes due to COVID-19. The State of Michigan reported an unemployment rate of 7.3 in December, a higher rate than what was reported in November, which was 6.3. For the City of Detroit, the unemployment rate for December of 2020 was 20.3, which is higher than the November rate of 18.7. The December unemployment data further highlights how the unemployment gap between the State and Detroit continues to grow wider as the COVID case numbers increased rapidly over the holidays.

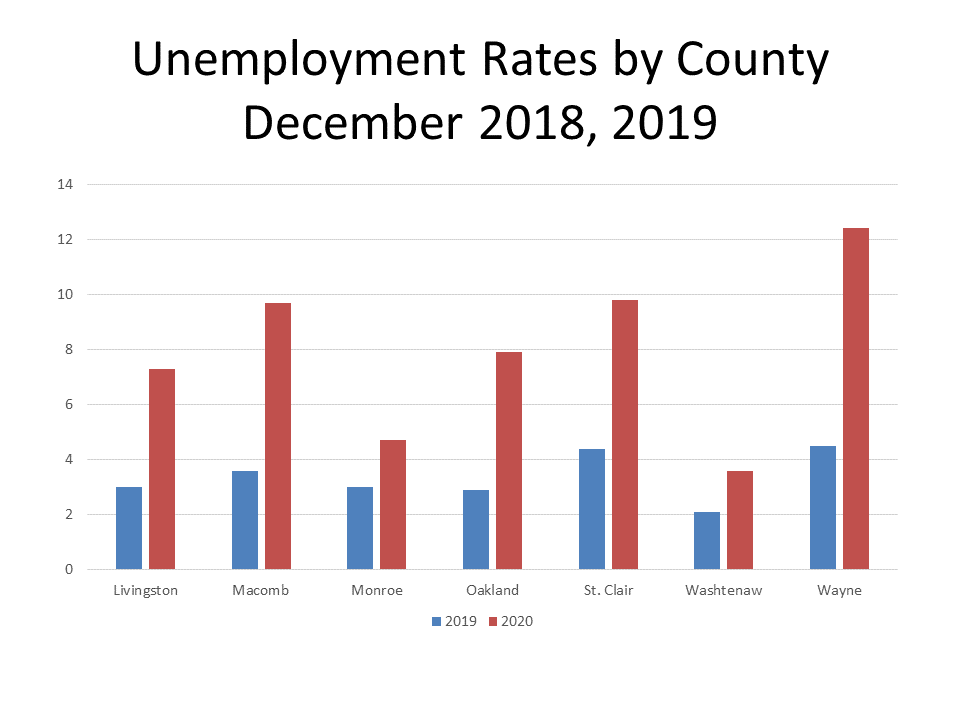

In line with what was reported above, COVID impacted unemployment rates at the county level in Michigan as well. In December of 2020 each county in Southeastern Michigan had a significantly higher unemployment rate than the year prior. According to data from the Michigan Department of Technology, Management and Budget, Wayne County experienced the largest increase at about 8 points. In December of 2020 Wayne County had an unemployment rate of 12.4 and in December of 2019 it was 4.5. Washtenaw County experienced the smallest increase at 1.5 points. In December of 2020 Washtenaw County had an unemployment rate of 3.6 and in December of 2019 it was 2.1. While there were overall unemployment increases, the differences in the unemployment percentages between each county is, at least in part, dependent on the type of jobs available in each county and the occupations of residents. For example, in Wayne County the top occupations are office and administrative support, production and sales and food service. In Washtenaw County the top occupations are office and administrative support, education instruction, health care practitioners and food service workers. Throughout much of the year some positions related to office and administrative support and food service have been considered non-essential or experienced higher layoff rates while those in health care and education have been at less risk of being unemployed.

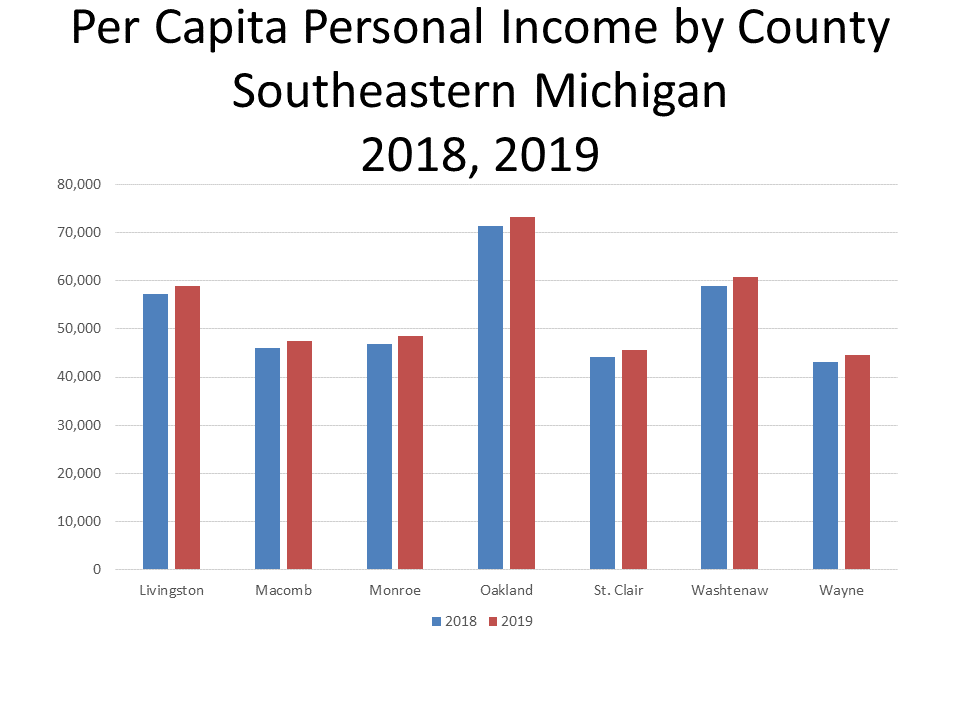

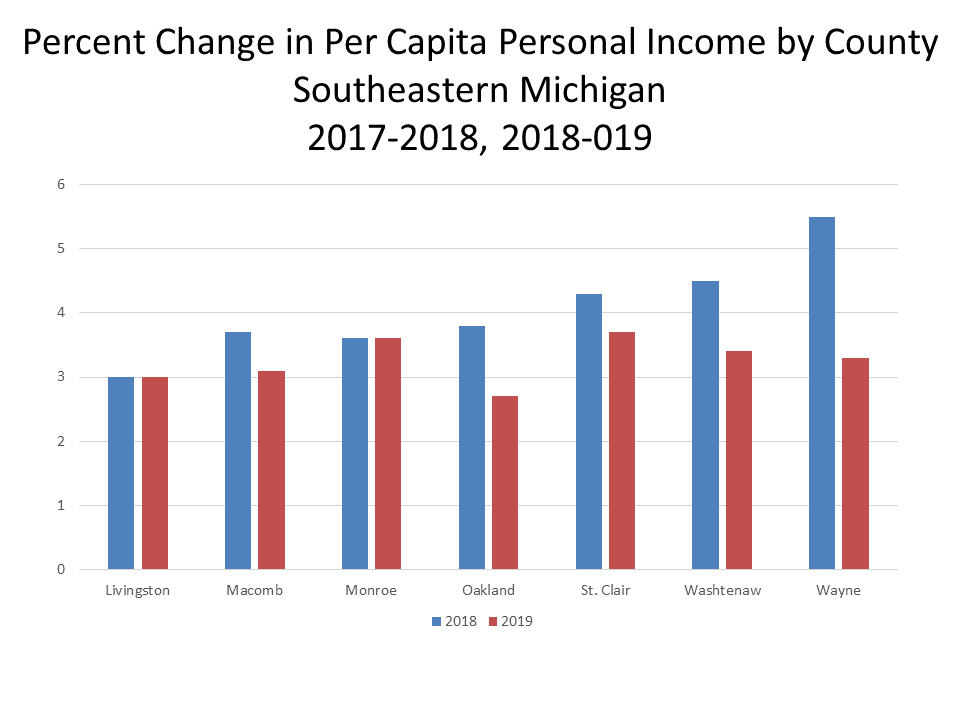

The Bureau of Economic Analysis recently released data on the per capita personal income by county for 2019, showing that overall incomes in Southeastern Michigan did grow between 2018 and 2019. In 2019 Oakland County had the highest per capita personal income at $72,271 but it had the lowest percent change between 2018 and 2019 at 2.7 percent. Wayne County had the lowest per capital personal income at $44,512 with the percent change from the year prior being 3.3 percent. St. Clair County had the lowest percent change in per capita income between 2018 and 2019 and 2.7 percent; its per capita personal income in 2019 was $45,662.

When examining personal income growth between 2017-18 and 2018-19 the percent change was lowest for the most recent year of data, as opposed to the growth from between 2017-18.

We have yet to know what the impact COVID will have on personal income for 2020, but the data below does show that growth was already beginning to slow down prior to the pandemic. That coupled with higher rates of unemployment, business closures and decreases in spending on goods and services may very well mean lower personal incomes for 2020.

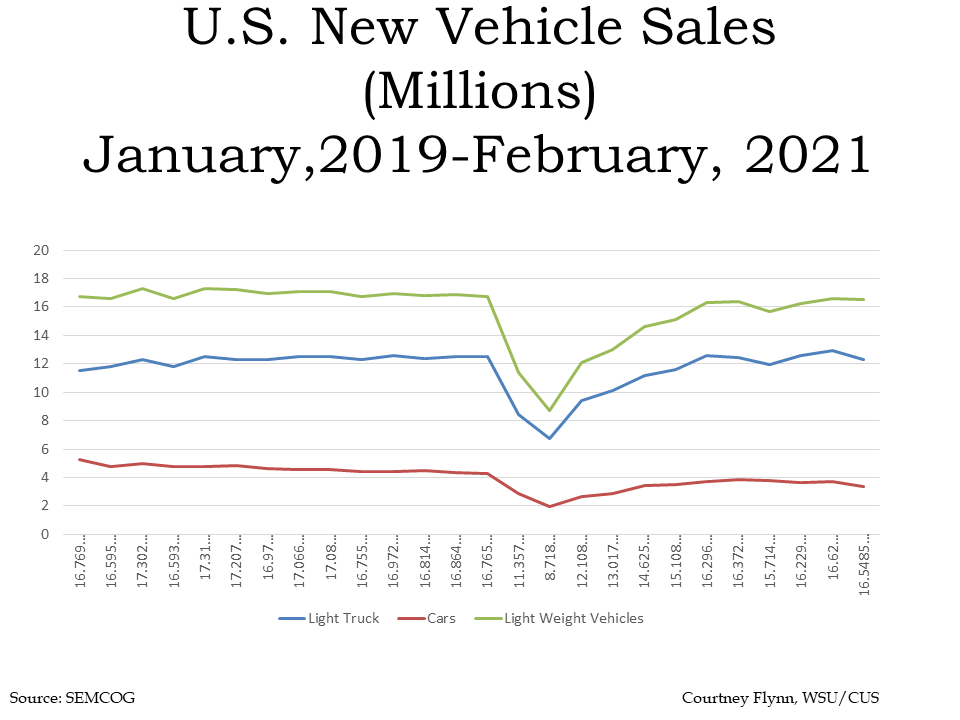

The automobile industry continues to be a driving force in Michigan’s economy and the latest data on vehicle sales show that the number of auto sales for lightweight vehicles has been steadily increasing in recent months while light truck and car sales slightly declined in February of 2021. However, compared to a year ago, sales still remain below what they were. In February of 2021 auto sales for: sales of light weight vehicles were 16.5 million, compared to 16.8 million the year prior; light truck sales were 12.3 million compared to 12.5 million in February of 2020; car sales were 3.4 million, compared to 4.2 million the year prior.

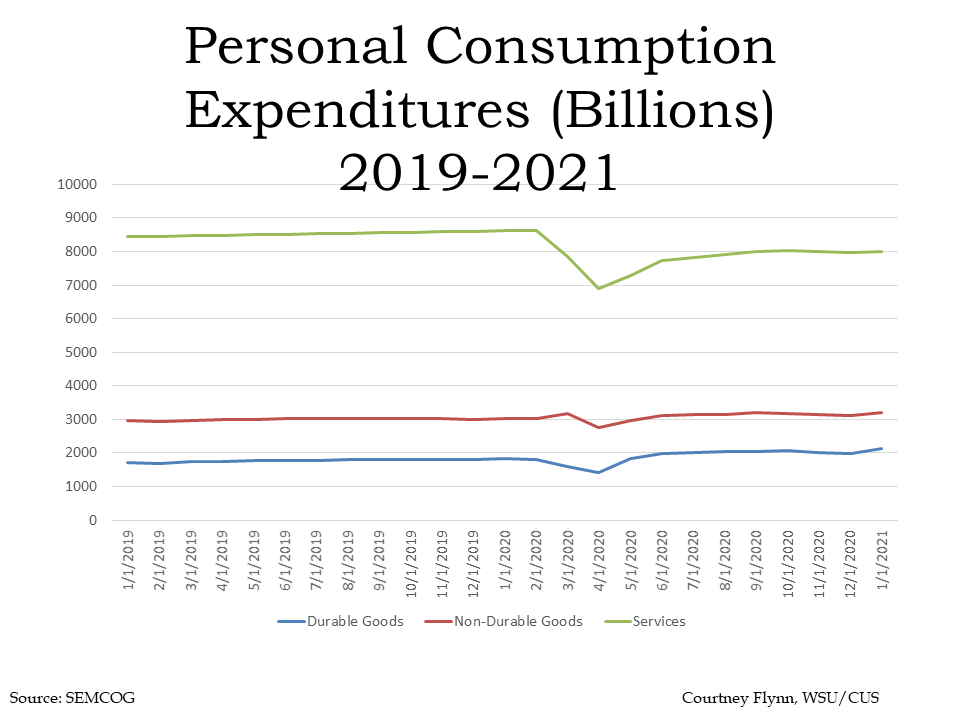

Below shows the consumption expenditures of goods in the U.S. between 2019 and 2021. According to the U.S. Bureau of Economic Analysis, durable goods have an average useful life of at least 3 years (e.g. motor vehicles) while nondurable goods have an average useful life of less than 3 years (e.g. food) and services are commodities that cannot be stored or inventoried and are consumed at the time of purchase (e.g., dining out). The chart below shows how services have yet to make it back to the pre-COVID consumption levels, but the consumption of durable and non-durable goods have risen. In January of 2021 $8,016 billion in services was consumed, $2,148 billion in goods was consumed and $3,206 billion in nondurable goods was consumed.

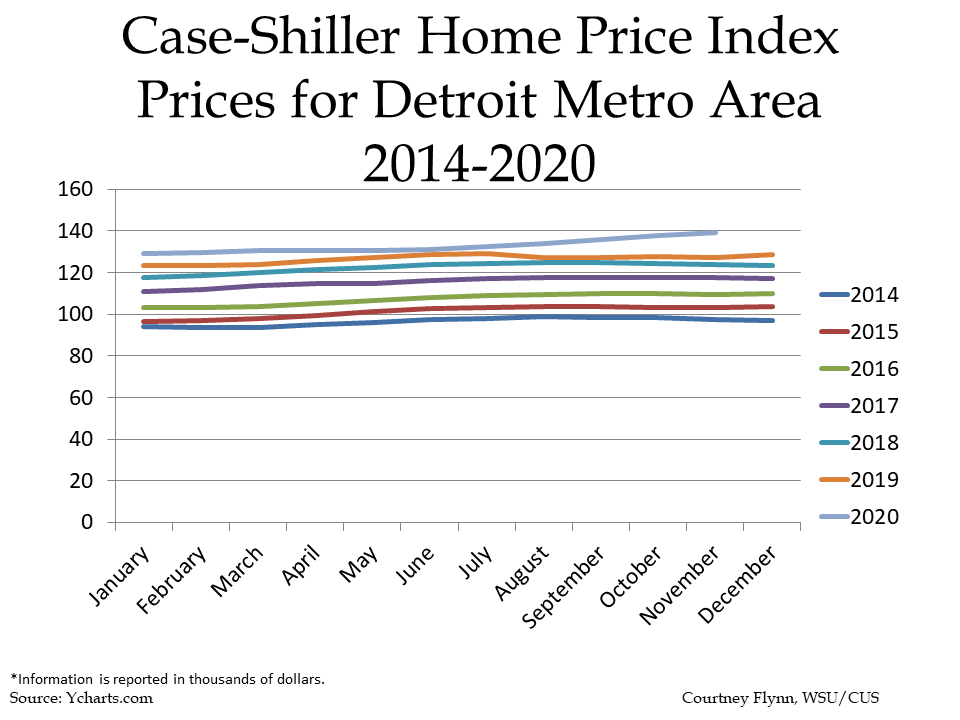

According to the Case-Shiller Home Price Index, the average price of single-family dwellings sold in Metro Detroit was $139,240 in November of 2020; this was $145 higher than the average family dwelling price in October. The November 2020 price was an increase of $11,770 from November of 2019 and $15,200 from November of 2018. So, just as unemployment rates remain higher than what they were a year ago so do average home prices. This is interesting though because with higher unemployment rates traditionally comes lower incomes and hesitation around the housing market. However, during the COVID-19 pandemic, as shown, the average price for a home has been increasing despite higher unemployment rates. Demand for existing homes has been up substantially across the nation over the last year