In 2021 more than $1.1 billion was reported in adult-use marijuana sales in the State of Michigan, and of that more than $42.2 million is being disbursed to municipalities and counties, $49.3 million is being sent to the School Aid Fund for K-12 education and another $49.3 million is being sent to the Michigan Transportation Fund. These revenue sales occurred in the 374 dispensaries licensed in the State of Michigan, which are spread out across 53 counties. In total, there was $172 million available for distribution from the fund set up by the Michigan Regulation and Taxation Marijuana Act, and more than $111 million was collected from the 10% adult-use marijuana excise tax.

Of the funds earned through the excise tax, $20 million is to be provided annually to one or more clinical trials that research the efficacy of marihuana in treating the medical conditions of United States armed services veterans and preventing veteran suicide. Once these funds are dispersed, and administration of the regulation department is paid for, the unexpended balances must be allocated as follows: •15% to municipalities in which a marihuana retail store or a marihuana microbusiness is located, allocated in proportion to the number of marihuana retail stores and marihuana microbusinesses within the municipality;

•15% to counties in which a marihuana retail store or a marihuana microbusiness is located, allocated in proportion to the number of marihuana retail stores and marihuana microbusinesses within the county; •35% to the school aid fund to be used for K-12 education;

•35% to the Michigan transportation fund to be used for the repair and maintenance of roads and bridges.

For 2021, each eligible municipality and county will receive more than $56,400 for every licensed retail store and microbusiness located within its jurisdiction.

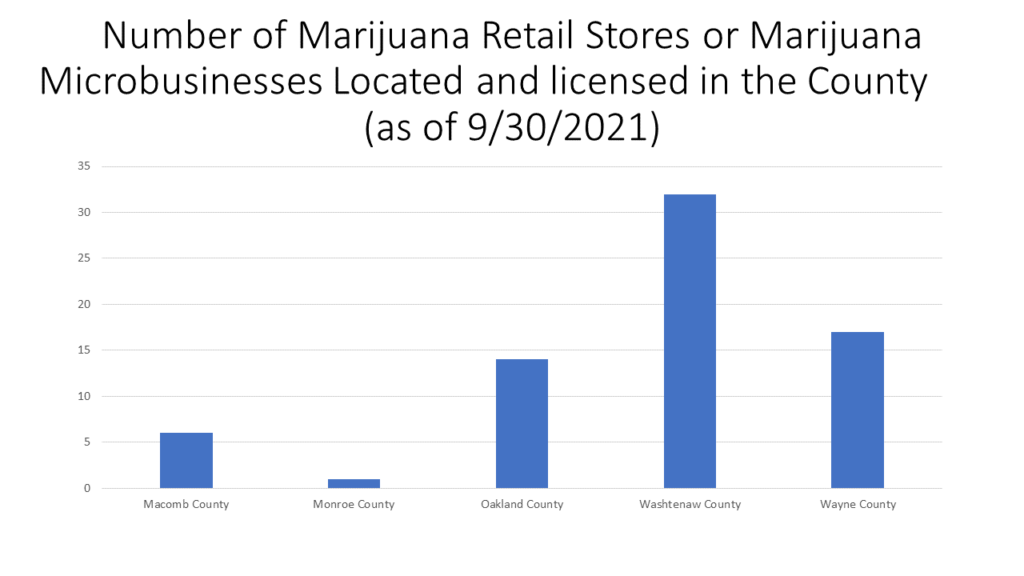

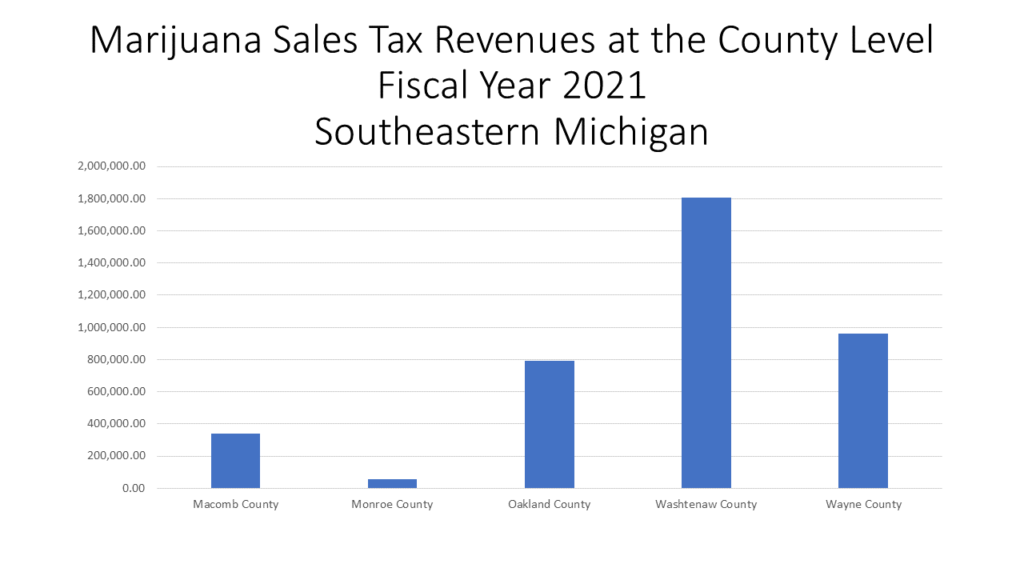

In the seven county region for Southeastern Michigan, five of the seven counties have licensed marijuana retail stores and/or microbusinesses, with Washtenaw County having the highest number of licenses at 32. Since Washtenaw County has the highest number of licenses it is also receiving the most amount of tax revenue. Washtenaw County, as the entity itself, will be receive about $1.8 million, according to the Michigan Department of Treasury. Wayne County will receive about $960,000, and Monroe County will receive the lowest amount at about $56,500. Monroe County has one licensed marijuana business and Wayne County has 17.

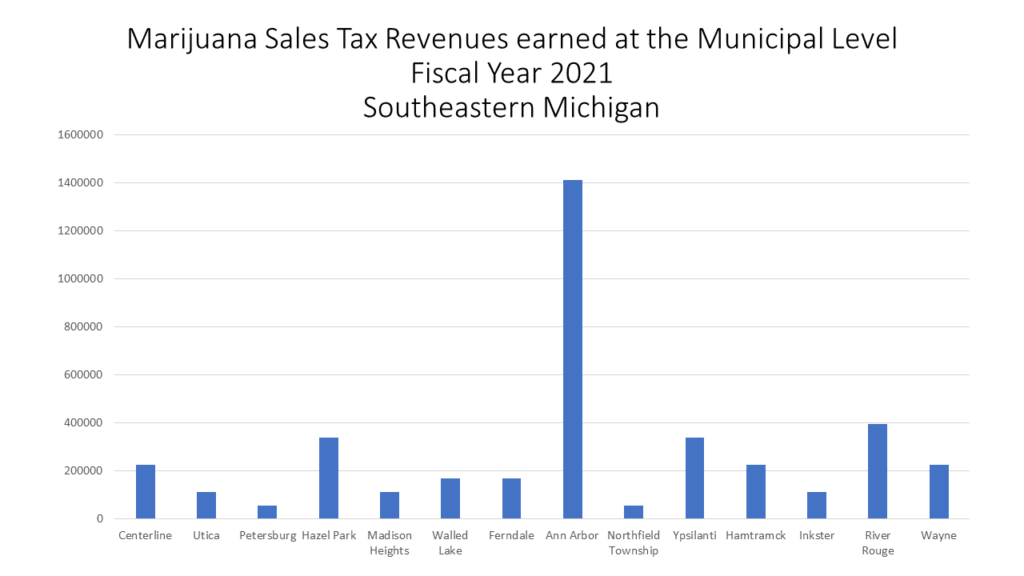

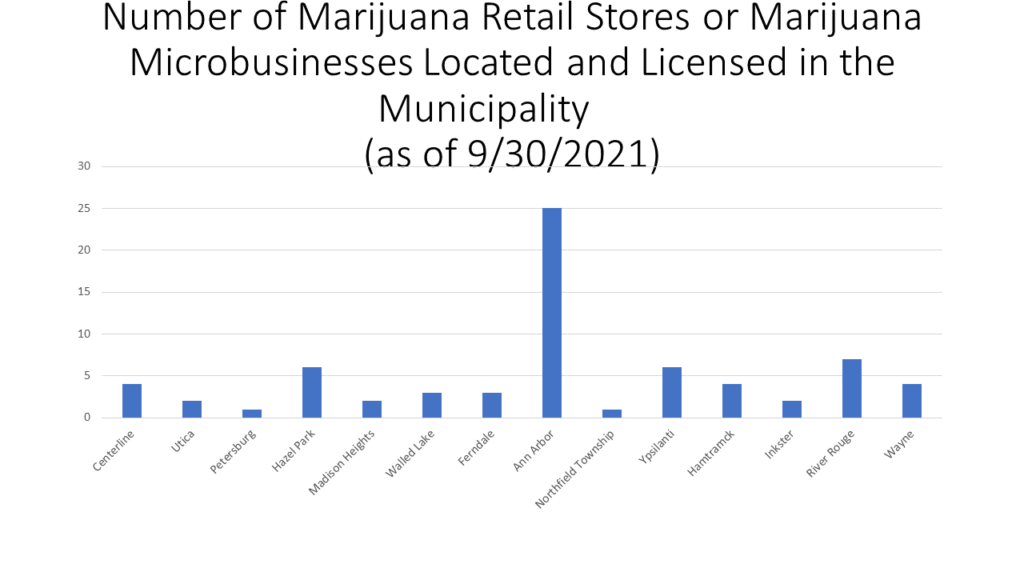

As noted, Washtenaw County has the highest number of licenses and will receive the highest amount of revenue payments, this is because Ann Arbor alone has 25 licensed marijuana retail stores and/or microbusinesses. Ann Arbor, according to the Department of Treasury, will receive about $1.4 million in revenue payments because of these businesses and the distribution formula set by the Michigan Regulation and Taxation Marijuana Act.

At the city/township/village level, River Rouge in Wayne County has the second highest number of licenses in the region at 7. River Rouge is set to receive about $395,000 in revenue funds through the tax.

While municipalities across the state are earning additional revenues through the marijuana excise tax from recreational sales, up until recently Detroit was one notable community that did not. However, in April of 2022 the Detroit City Council approved medicinal marijuana to be sold within the city limits through the adoption of a recreational ordinance.