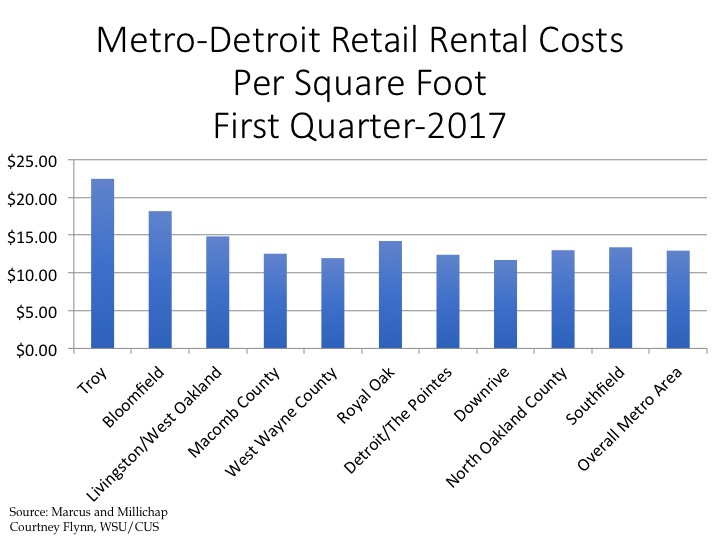

This post focuses in on key business climate indicators in the Detroit Metro area. We examine retail rental rates, the changes in these rates, vacancy rates for both retail and industrial property, and employment by sector.

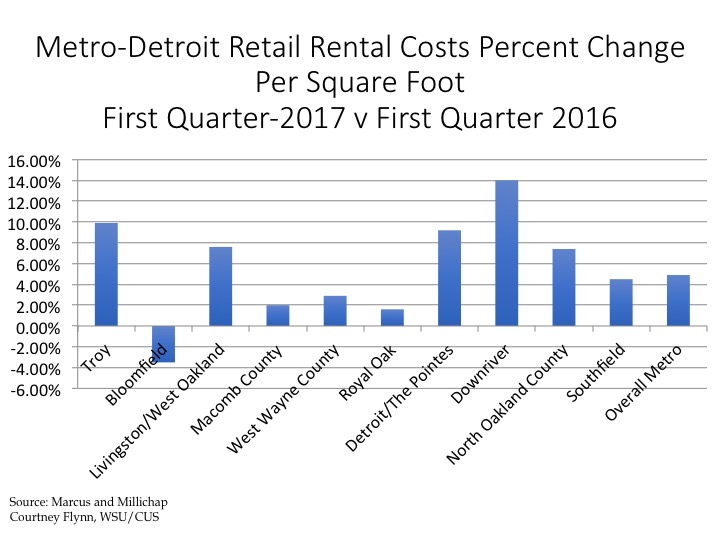

The two charts above describe the per square foot cost of retail rental space, and the change in that cost throughout the Detroit metropolitan region. In the first quarter of 2017 the City of Troy had the highest retail rental costs per square foot at $22.45, according to Marcus and Millichap. Troy also had a 10 percent increase from the first quarter of 2016. While the City of Troy did experience one of the larger retail rental cost increases over the last year, it was the Downriver area that experienced the largest increase. Between the first quarter of 2016 and the first quarter of 2017 there was a 14 percent rental cost increase in the Downriver area. By the first quarter of 2017 retail rental space cost $11.71 per square foot in Downriver; this was the lowest cost in the region.

Overall, the average retail rental cost per square foot in the Metro region was $12.94.

With retail rental costs the highest in the Troy area it is no surprise that that area in the region had the lowest vacancy rate at 2 percent during the first quarter of 2017, according to Marcus and Millichap. On the opposite side of the spectrum, Southfield had the highest retail vacancy rate at 12.1 percent; the cost of retail rental space per square foot in Southfield during the first quarter of 2017 was $13.39.

The overall retail space vacancy rate in the Metro region during the first quarter of 2017 was 6.8 percent.

Compared to retail space vacancies (6.8%), overall there were lower industrial vacancy rates (an average of just over 2%) throughout the region. The Royal Oak/Southfield area had the highest vacancy rate in the first quarter of 2017 at 5.5 percent while the Eastern section of the Metro region had the lowest rate at 1.7 percent, closely followed by the Troy area and Washtenaw. The highest industrial vacancies were in the Royal Oak-Southfield area.

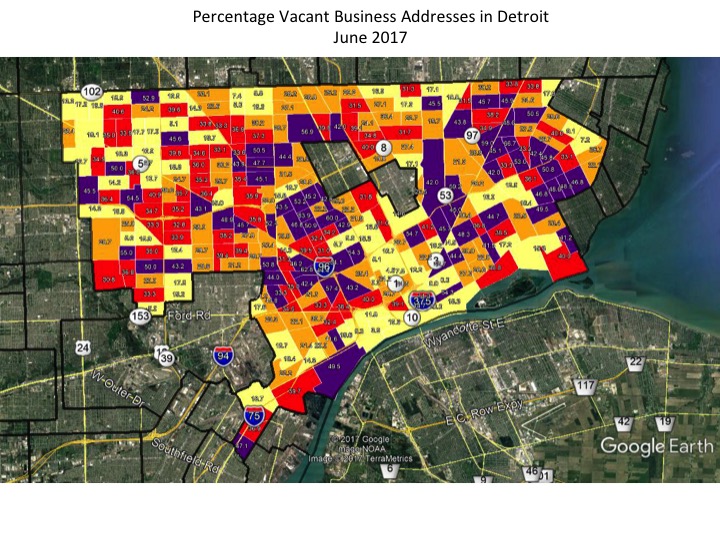

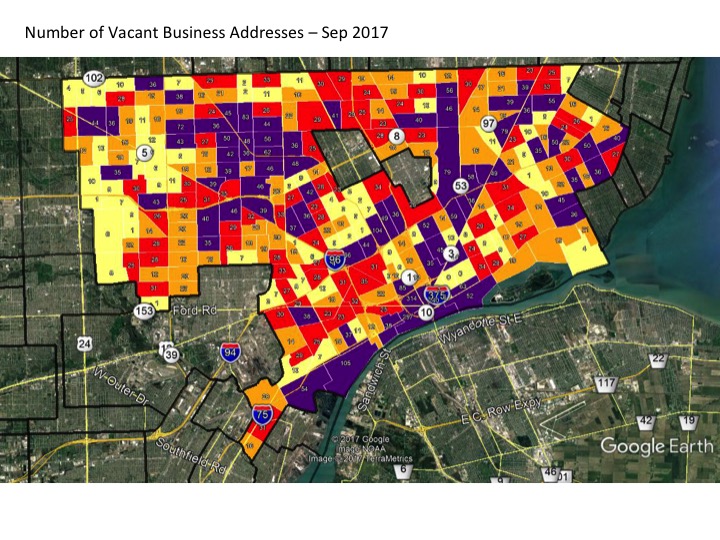

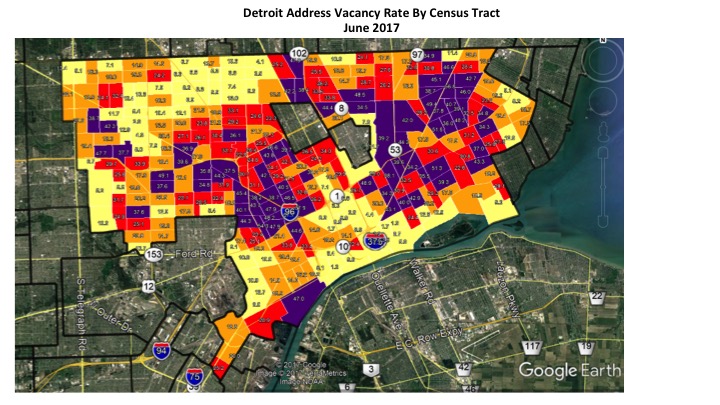

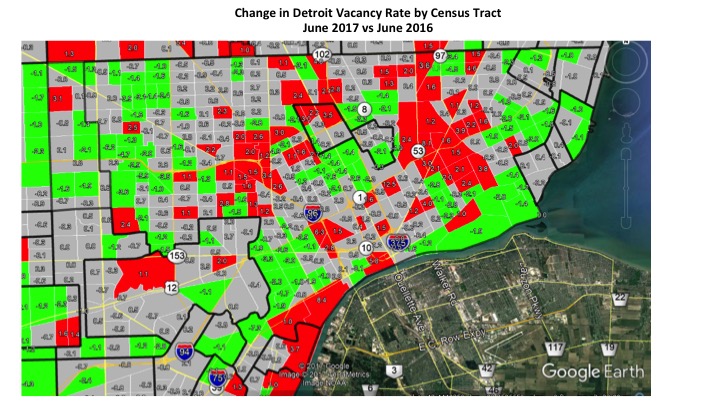

In June of 2017, according to the data from the U.S. Postal Service, there were 7,932 total vacant business addresses in the City of Detroit; this number is a 324 vacancy increase from June of 2016. Overall, the business address vacancy rate in the City of Detroit was 27.5 percent in June of 2017; there were a total of 28,844 reported business addresses. The maps above show by Census Tract where the highest and lowest business address vacancies were by both number and percentage. In total, as shown in the first map, the Southwest Detroit region along the Detroit River had the highest number of business address vacancies. The Census Tract with the highest number of vacancies was located in that area; there were a reported 314 business vacancies in one Census Tract.

In addition to the Southwest Detroit cluster of high business address vacancies there was also a cluster just west of Highland Park and another cluster along M-53. While these clusters did not have as high of business vacancy numbers as Southwest Detroit, in several cases, Census Tracts in these clusters had higher percentages of business vacancy rates. For example, in a Census Tract just east of M-53, there was a business address vacancy rate of about 59 percent; this was the highest percentage in the City of Detroit in June of 2017.

Overall, this data shows that business vacancies are increasing overall in the City, but the higher percentage of vacancies tend to be located in business and industrial districts outside of Downtown Detroit.

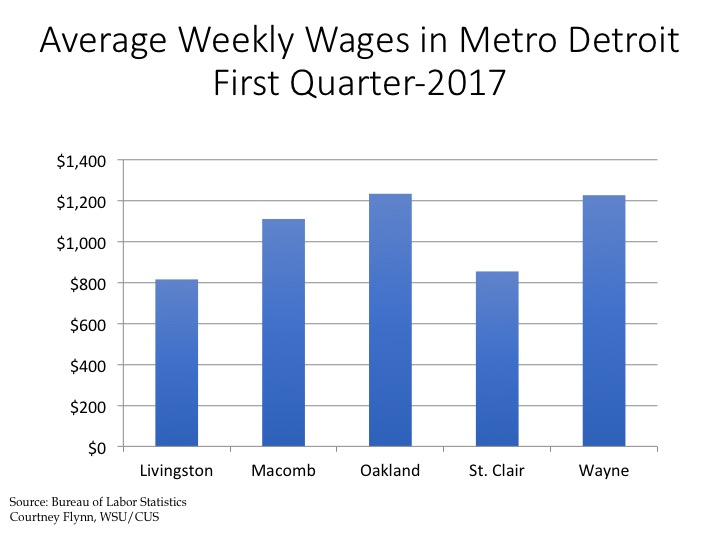

According to information from the Bureau of Labor Statistics (BLS) , during the first quarter of 2017 Wayne County had the highest average weekly wages at $1,266 while St. Clair County had the lowest at $854.

The BLS does not include Washtenaw and Monroe counties in their Metro-Detroit Economic Summary updates, which is why they are not included in the chart above.

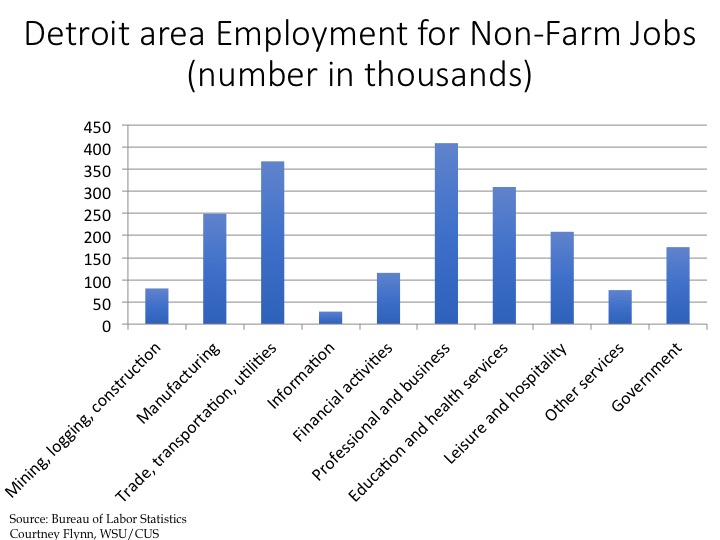

According to the BLS, the professional and business sector in the Metro-Detroit region had the highest number of employees at 408,800 while the information sector had the lowest number of employees at 28,300. The trade, transportation and utilities sector had the second highest number of employees at 367,700. The manufacturing industry had 249,400 employees, and the government sector had 173,900 employees.